VERITAS

PROJECT OVERVIEW

Design challenge – Design a mobile app for a bank that helps customers select, set up and manage a personal bank account without visiting in person.

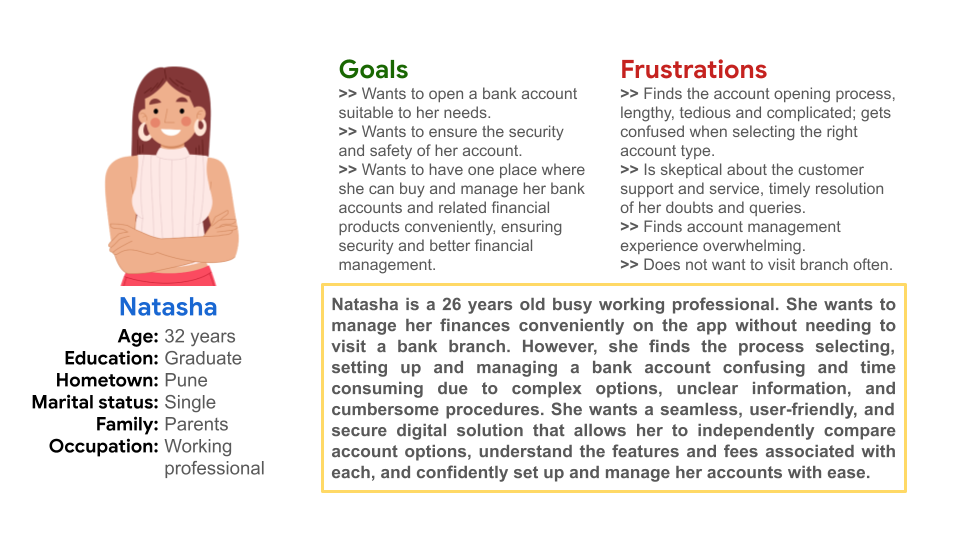

Problem statement: In an increasingly digital world, customers expect the convenience of managing their finances online without needing to visit a bank branch. However, many individuals find the process of selecting, setting up, and managing a personal bank account confusing and time-consuming due to complex options, unclear information, and cumbersome procedures that often require in-person verification or assistance.

For banks, the challenge is to offer a seamless, user-friendly, and secure digital solution that allows customers to independently compare account options, understand the features and fees associated with each, and confidently set up and manage their accounts with ease.

Goal: To develop a user-centric mobile application that simplifies the process of selecting, setting up, and managing personal bank accounts, enabling customers to navigate their financial options with clarity and confidence. This app will provide a seamless, fully digital experience by offering intuitive comparisons of account features and fees, clear guidance throughout the onboarding process, and ongoing management tools. Our objective is to enhance customer satisfaction, foster trust in digital banking, and significantly reduce the need for in-person branch visits, thereby transforming the way individuals engage with their finances in an increasingly digital world.

PAIN POINTS

Pain point 1

Users find the account opening process, especially documentation, lengthy, tedious and complicated.

Pain point 2

Users get confused when selecting the right account type for them, as bank is offering many account types.

Pain point 3

Users are skeptical about the customer support and service, timely resolution of their doubts and queries.

Pain point 4

User find account management experience overwhelming as too many products and features are displayed.

Persona

COMPETITIVE AUDIT

Competitive audit was conducted to understand how competitors are projecting themselves in the market and what features they are offering. Mobile apps of the following banks were studied and compared in this analysis. Check the audit report below.

- Axis bank

- ICICI bank

- HDFC bank

- SBI

- Kotak Mahindra bank

Check the audit report on the link below.

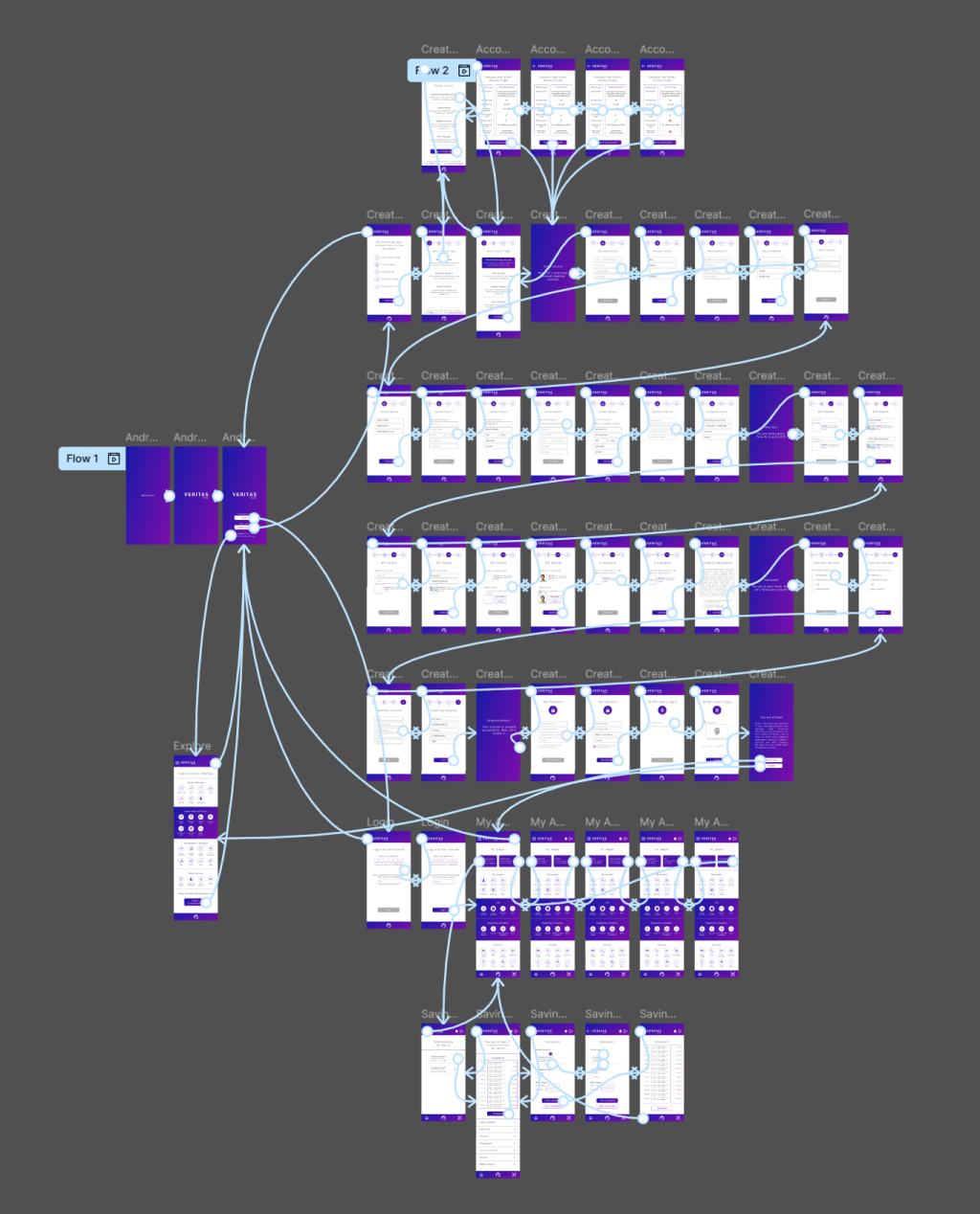

DESIGN PROCESS

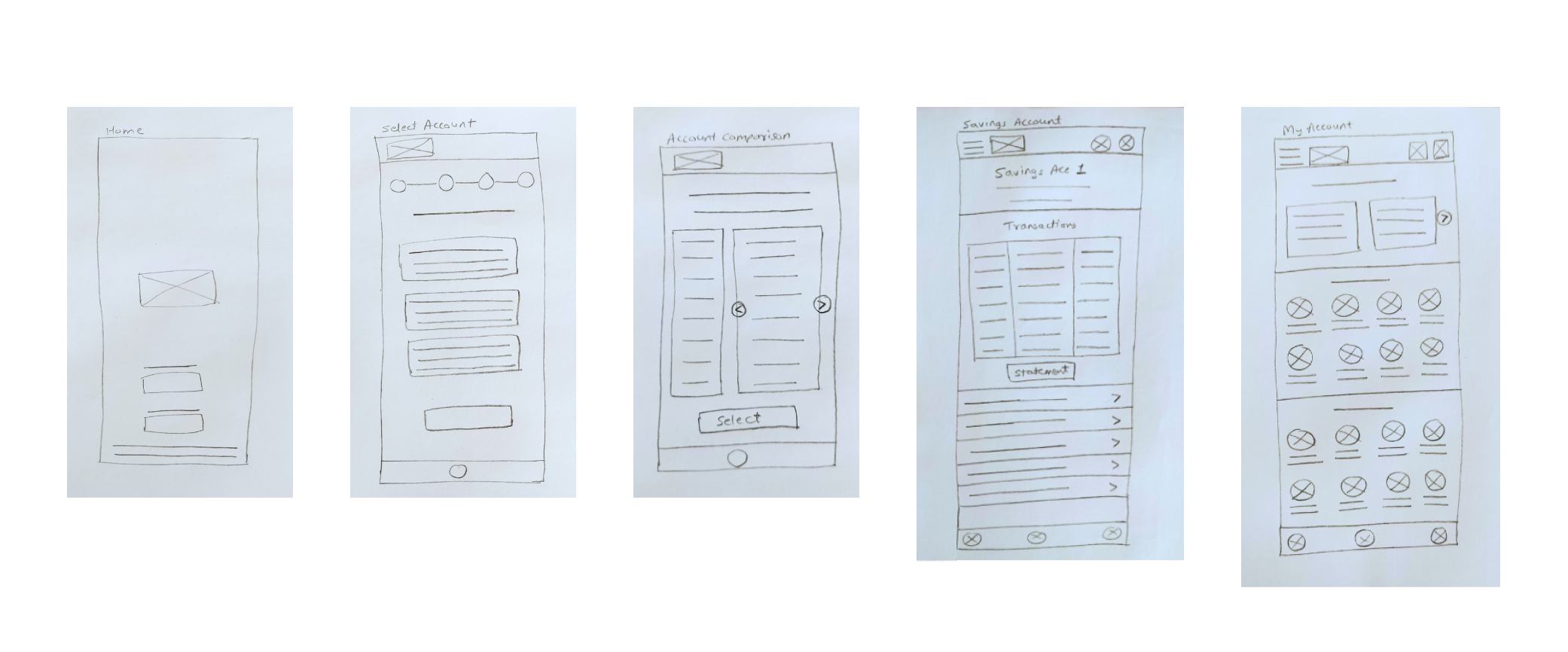

Paper wireframes

Logo

Design decisions

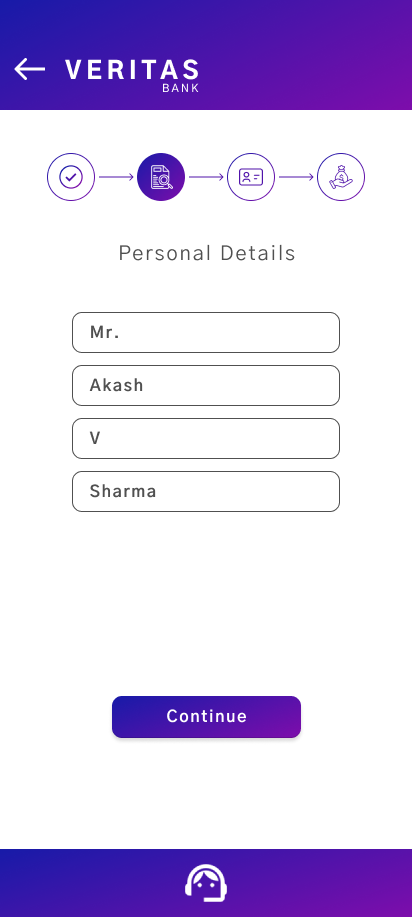

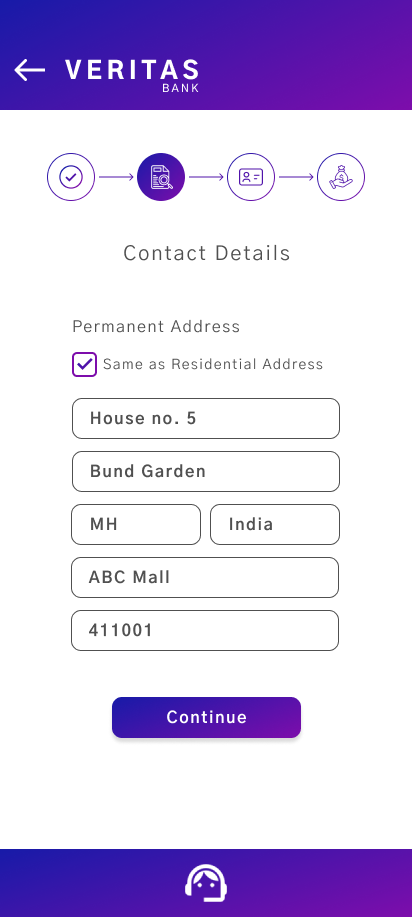

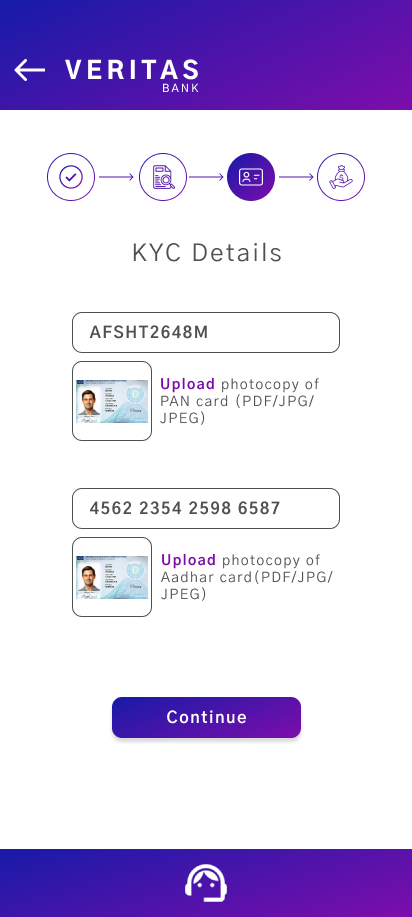

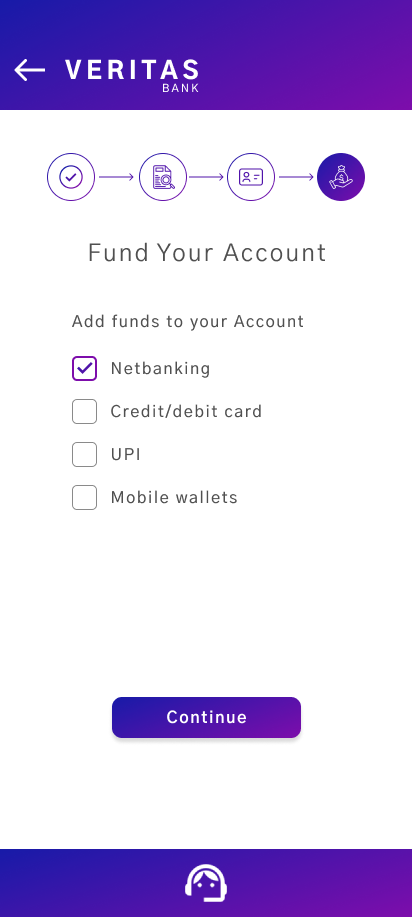

Pain point 1 – Users find the account opening process, especially documentation, lengthy, tedious and complicated.

Solutions –

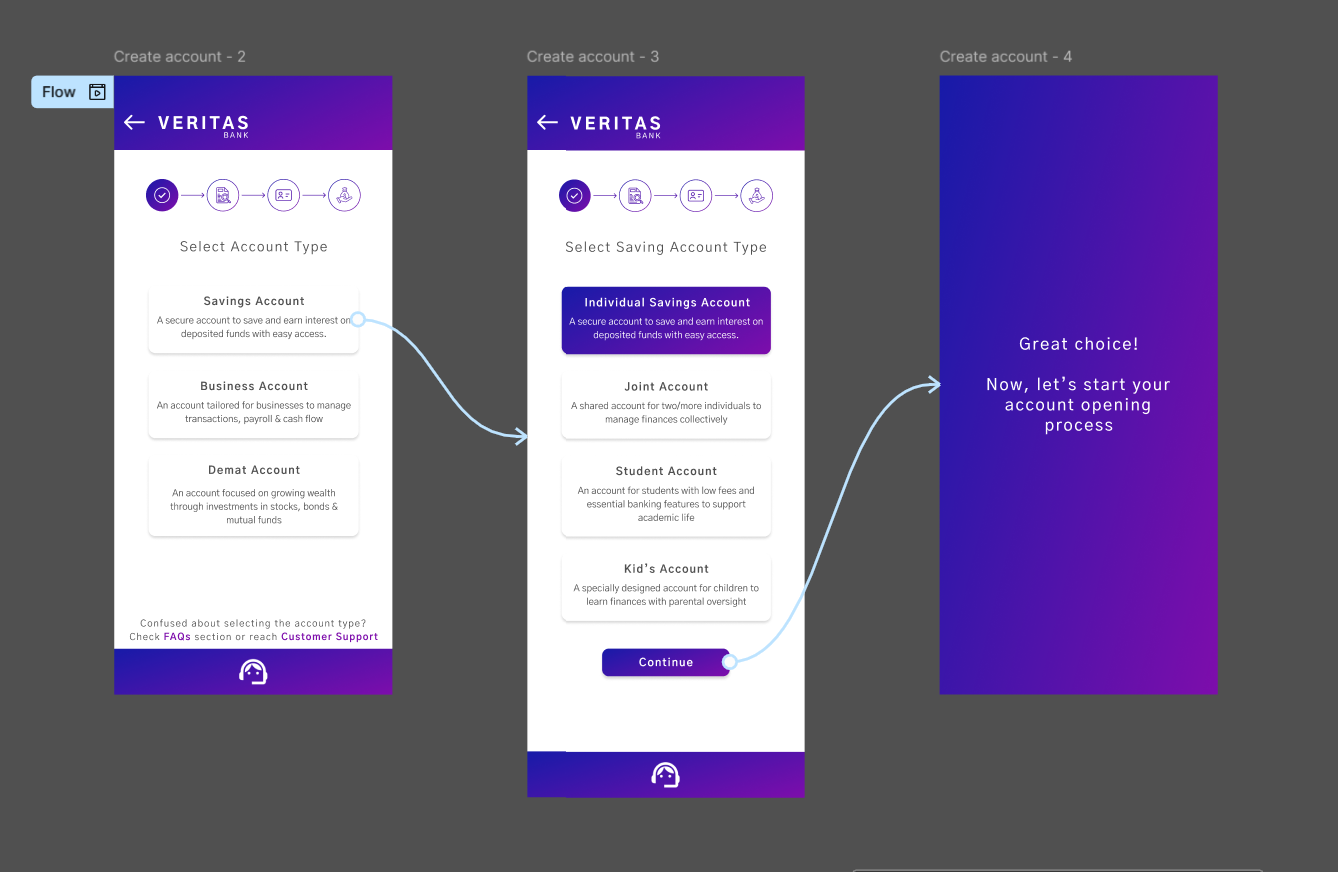

- Progress bar indicates where exactly user stands in the process.

- Each step is kept small, simple and clear to avoid confusion.

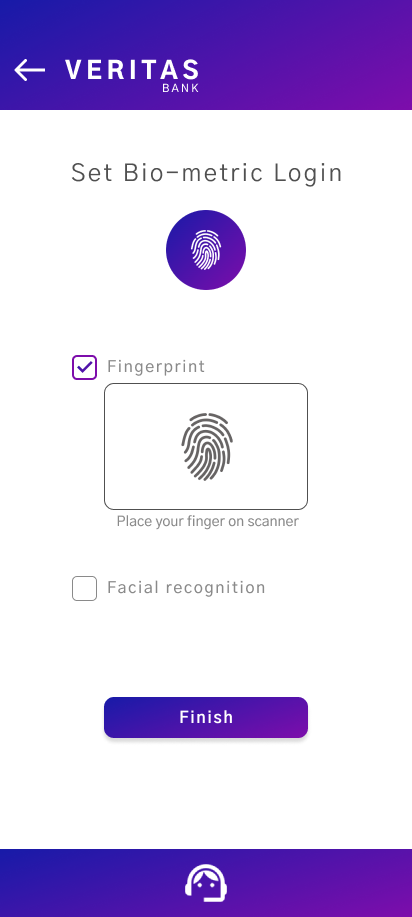

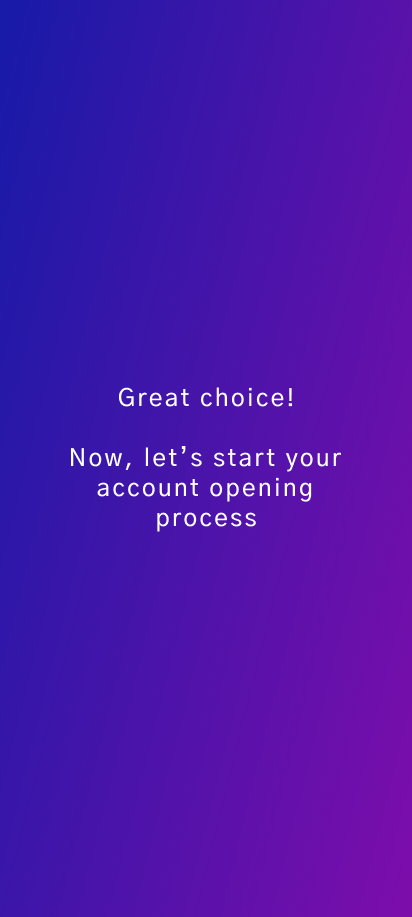

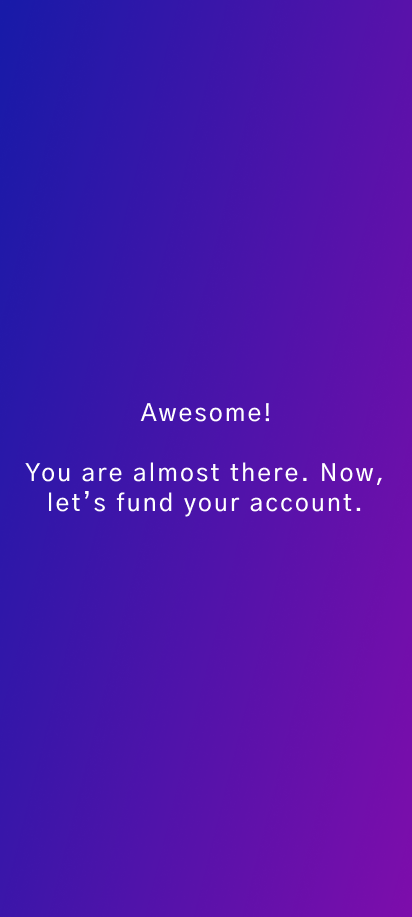

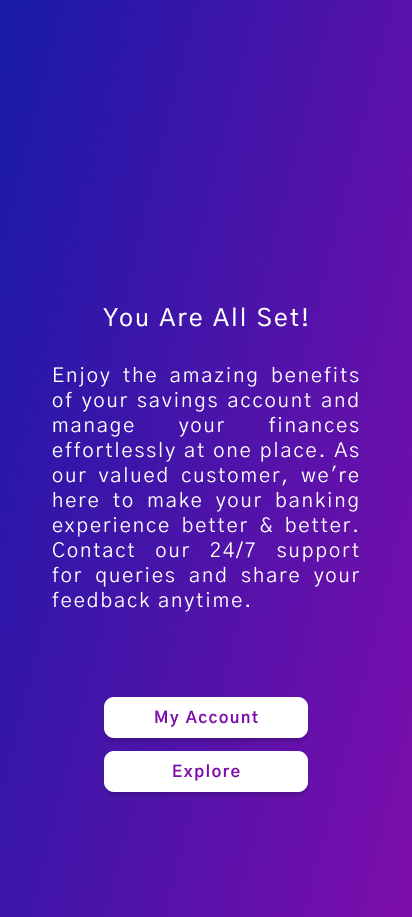

Solution – Message screens after completing every milestone keep the users informed and motivated.

Pain point 2 – Users get confused when selecting the right account type for them, as bank is offering many account types.

Solution – Accounts are divided in broad categories and then divided in subcategories for better decision making.

Solution – Comparison feature to help users select right account type without confusion and make informed decision.

Pain point 3 – Users are skeptical about the customer support and service, timely resolution of their doubts and queries.

Solution – Customer support icon is provided on the bottom bar on every screen to make it easily accessible.

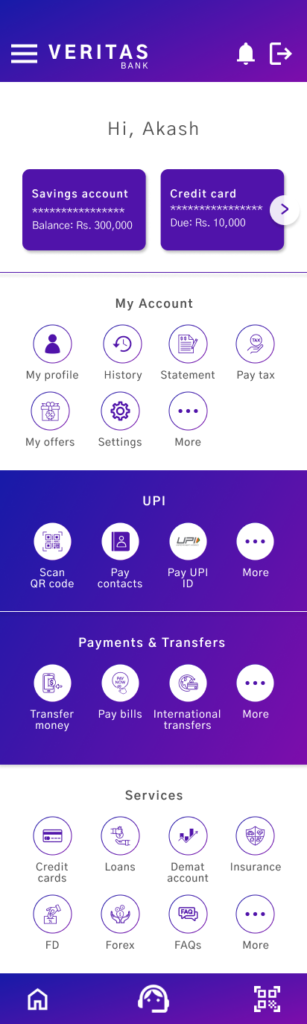

Pain point 4 – User find account management experience overwhelming as too many products and features are displayed.

Solutions –

- Features are divided and placed in different sections.

- Features are arranged top to bottom starting from frequently used features.

- QR code scanner provided at the bottom bar for easy access as it is the most commonly used feature.

- Layout is similar to that of most other banking apps to make it familiar. (Jakob’s law)

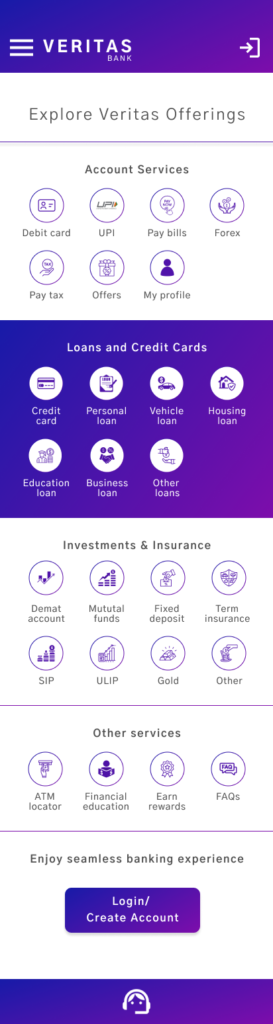

Solutions – On the explore page, features are organized in main categories for better clarity.

HI FIDELITY PROTOTYPE